3D Printing Mastery – Unleash Your Creativity

Discover the art and science of 3D printing with tips, tutorials, and innovative designs.

Marketplace Liquidity Models: Where Dollars Dance and Data Rules

Unlock the secrets of marketplace liquidity! Discover how dollars dance and data drives decisions in our insightful blog. Dive in now!

Understanding the Dynamics of Marketplace Liquidity: Key Models Explained

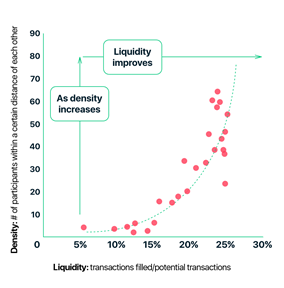

Marketplace liquidity refers to the ease with which assets or products can be bought and sold in a marketplace without causing a significant impact on their price. Understanding this concept is critical for both buyers and sellers, as it directly affects their ability to execute trades effectively. The dynamics of marketplace liquidity can be categorized into several key models, each highlighting unique factors that contribute to the overall liquidity of a market. Liquidity models often emphasize aspects such as the order flow, market depth, and transaction speed, all of which play a significant role in determining how quickly and efficiently transactions can occur.

One prevalent model is the Order Book Model, which illustrates how buy and sell orders interact in a trading environment. This model showcases how order placement affects market liquidity; a highly populated order book with numerous buy and sell orders generally indicates a liquid market. Conversely, a sparse order book may signal lower liquidity, impacting the ability of traders to enter or exit positions without affecting the price significantly. Additionally, the Market Maker Model plays a crucial role in sustaining liquidity, as market makers provide buy and sell quotes, ensuring there's always a counterparty available for trades. Understanding these models enables traders to navigate the complexities of marketplace liquidity more effectively.

Counter-Strike is a highly popular first-person shooter game that has captivated millions of players globally. With its team-based gameplay, players can choose to fight as terrorists or counter-terrorists in various game modes. Players often seek ways to enhance their gaming experience, and one popular method is by using a daddyskins promo code to unlock unique skins and items.

The Impact of Data on Marketplace Liquidity: Insights and Analysis

The impact of data on marketplace liquidity cannot be overstated. In today's digital economy, the availability and analysis of data play a crucial role in determining how easily assets can be bought or sold in a marketplace. A well-structured dataset allows for better pricing strategies, improved transaction speeds, and enhanced buyer-seller matching. For instance, marketplaces that leverage real-time data analytics are often able to make more informed decisions, ultimately leading to increased liquidity. Without a solid foundation of data, traders and investors may face difficulties in executing trades, resulting in greater price volatility and slippage.

Furthermore, data-driven insights are essential in shaping the overall trading environment. By analyzing patterns, trends, and historical performance, stakeholders can gain a deeper understanding of market dynamics. This can lead to more efficient allocation of resources and a reduction in transaction costs. According to a recent study, marketplaces that implement robust data analytics report a significant increase in liquidity, with some experiencing up to a 50% improvement in trade execution times. As digital marketplaces continue to evolve, prioritizing data utilization will be key to maintaining competitive advantage and ensuring a sustainable trading ecosystem.

How Do Marketplace Liquidity Models Influencing Consumer Behavior?

The concept of marketplace liquidity models plays a crucial role in shaping consumer behavior within various economic environments. Liquidity refers to how easily assets can be bought or sold in the marketplace without affecting their price. High liquidity often leads to increased consumer confidence as buyers and sellers can transact swiftly and efficiently. This dynamic causes consumers to engage more actively in the market, as they perceive less risk involved in purchasing decisions. For instance, platforms with robust liquidity models typically showcase a diverse range of products, appealing to a broader audience by meeting varying demand levels.

Additionally, liquidity models influence pricing strategies and inventory management, which can subsequently affect consumer purchasing patterns. In highly liquid marketplaces, prices tend to stabilize due to rapid transactions and competitive dynamics, prompting users to make quicker purchasing decisions. This behavior is particularly evident during sales events or promotions, where the urgency created by perceived scarcity can dramatically increase conversion rates. Understanding these behaviors aids sellers in strategizing their offerings to maximize sales and improve customer satisfaction, ultimately enhancing the overall marketplace experience.