3D Printing Mastery – Unleash Your Creativity

Discover the art and science of 3D printing with tips, tutorials, and innovative designs.

Marketplace Liquidity Models: The Balancing Act Between Buyers and Sellers

Discover the secrets behind marketplace liquidity models and how to perfectly balance the needs of buyers and sellers for maximum success!

Understanding the Fundamentals of Marketplace Liquidity: Key Concepts Explained

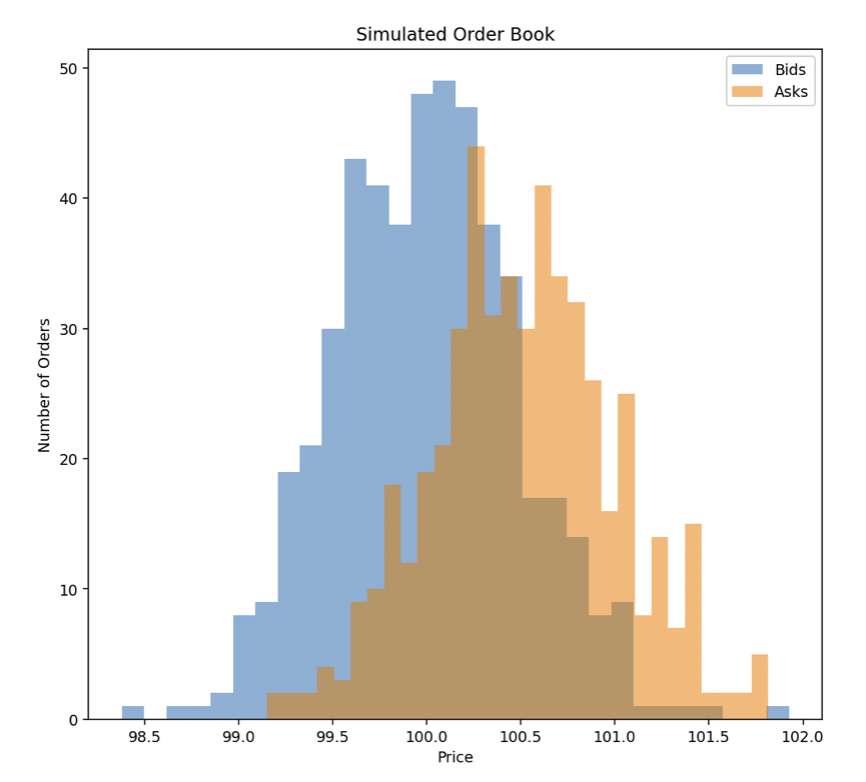

Marketplace liquidity refers to the ease with which assets can be bought or sold in a market without causing significant price fluctuations. Essentially, it indicates how quickly and efficiently transactions can occur. The concept of liquidity is crucial to understanding market dynamics, as it directly affects the pricing and volatility of assets. In a highly liquid market, numerous buyers and sellers are actively participating, making it easy to execute trades. On the other hand, a market with low liquidity may have fewer participants, leading to wider spreads between bid and ask prices and increased price volatility.

Several factors contribute to marketplace liquidity, including the number of participants, the volume of transactions, and the availability of information. For instance, markets with greater participation tend to exhibit higher liquidity. Additionally, order types play a significant role; limit orders can provide liquidity by ensuring that there are buyers and sellers at various price levels. Understanding these key concepts not only helps investors make informed decisions but also equips them to navigate the complexities of financial markets effectively.

Counter-Strike is a popular first-person shooter game that has been captivating players since its initial release in 1999. Known for its competitive gameplay, players can engage in team-based matches, focusing on objectives such as bomb defusal or hostage rescue. For those looking to enhance their gaming experience, using a daddyskins promo code can provide access to exciting in-game skins and items.

How to Optimize Liquidity in Your Marketplace: Strategies for Success

Optimizing liquidity in your marketplace is essential for ensuring a smooth trading environment and enhancing user experience. One effective strategy is to implement dynamic pricing models, which adjust prices based on demand and supply metrics. This approach can attract more buyers and sellers, helping to establish a healthier trading ecosystem. Furthermore, fostering partnerships with liquidity providers can also enhance market depth by ensuring there are always enough participants ready to trade, thus minimizing price fluctuations.

Another significant strategy is to utilize technology to facilitate quick and efficient transactions. Investing in advanced trading platforms that support seamless payment gateways and real-time transaction processing can greatly enhance liquidity. Additionally, consider offering incentives like lower transaction fees for high-volume trades, which can encourage users to transact more frequently. By focusing on these core areas, marketplace operators can effectively optimize liquidity and position themselves for long-term success.

What Factors Influence Buyer and Seller Balance in Marketplace Liquidity Models?

In the realm of marketplace liquidity models, several critical factors work together to shape the buyer and seller balance. One of the primary determinants is the pricing mechanism in place, which can influence participant engagement. When prices are set dynamically based on demand and supply, buyers and sellers tend to engage more actively in the marketplace. Additionally, transaction costs play a crucial role; lower costs can incentivize more buyers to enter the market, while higher costs may deter potential sellers from listing their goods. Market sentiment and external economic conditions also significantly impact participants' willingness to trade, as factors such as consumer confidence can lead to fluctuations in liquidity.

Another essential factor is the availability of information, as transparent data about market conditions can empower buyers and sellers to make informed decisions. When users have access to real-time analytics or performance indicators, they are more likely to engage in transactions, improving overall liquidity. Furthermore, the variety of payment options and logistical support provided by the marketplace can also enhance participation rates. Its user interface and overall user experience can drastically affect how easily buyers and sellers interact with the platform, ultimately influencing the balance of buyers and sellers and the liquidity within the market.