3D Printing Mastery – Unleash Your Creativity

Discover the art and science of 3D printing with tips, tutorials, and innovative designs.

Insurance Shopping: Don't Get Lost in the Fine Print

Navigate the insurance maze effortlessly! Learn how to decode fine print and find the best deals without the hassle. Start saving today!

Top 5 Insurance Terms You Need to Know Before Shopping

Before diving into the world of insurance shopping, it's essential to familiarize yourself with key terms that can greatly influence your choices. Understanding these concepts not only empowers you as a consumer but also ensures you make informed decisions that align with your needs. Here are the Top 5 Insurance Terms you need to know:

- Premium: This is the amount you pay for your insurance policy, typically on a monthly or annual basis. It is crucial to understand how premiums affect your overall budget and the level of coverage you receive.

- Deductible: The deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Knowing your deductible helps you gauge the affordability of claims and overall insurance costs.

- Copayment: This is a fixed fee you pay for specific services, such as doctor visits or prescription drugs, regardless of your deductible status. Familiarizing yourself with copayments can help in planning your healthcare expenses.

- Coverage Limits: Coverage limits define the maximum amount your policy will pay for covered losses. Understanding these limits is vital to ensure you're adequately protected without facing unexpected financial burdens.

- Exclusions: These are specific conditions or circumstances that are not covered by your policy. Knowing the exclusions can prevent surprises when you need to file a claim and aid in selecting the right policy for your needs.

How to Compare Insurance Quotes: A Step-by-Step Guide

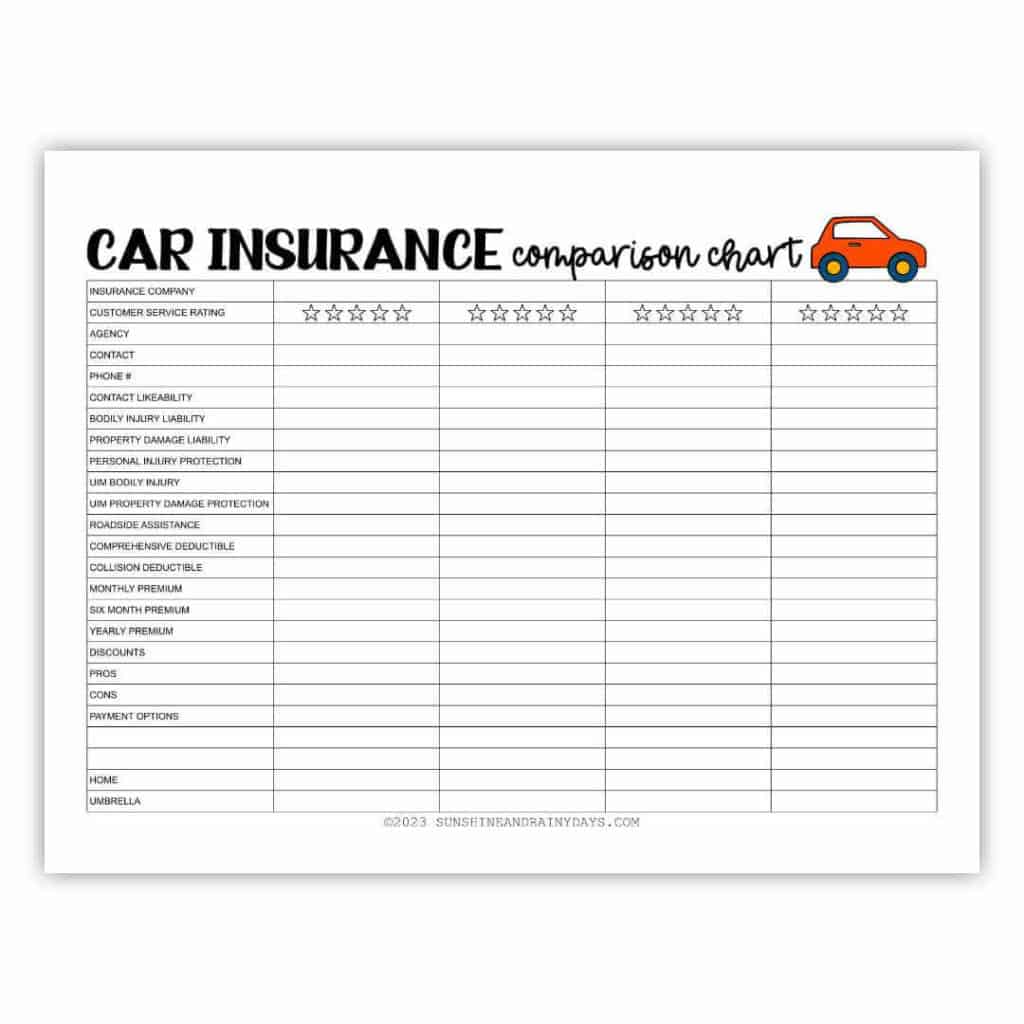

Comparing insurance quotes can seem overwhelming, but by following a step-by-step guide, you can simplify the process. Begin by gathering several quotes from different insurance providers. It’s essential to have a consistent criteria for comparison, such as coverage types, limits, and premiums. This allows you to place each quote side by side and identify the best deals available. Consider using tools like a spreadsheet to organize this information, which will help you visually analyze the differences.

Once you have your quotes, it’s time to delve deeper into the details. Look beyond just the bottom line; examine the coverage terms, exclusions, and customer reviews for each policy. Contacting agents with questions can also provide clarity on specific points. By doing thorough research and honest comparisons, you can ensure you're not only getting the best price but also the most suitable coverage for your needs.

Common Insurance Myths Debunked: What You Really Need to Know

When it comes to insurance, misinformation can lead to critical mistakes in coverage choices. One common myth is that all insurance policies are the same. In reality, policies vary significantly in terms of coverage limits, exclusions, and premiums. For example, a basic auto insurance policy may only cover liability, while a comprehensive plan could include theft and accident coverage. It's essential to thoroughly compare policies to find the one that best fits your needs.

Another prevalent misconception is that you don’t need insurance until you're older or have more assets. However, unexpected events can occur at any stage in life. For instance, a sudden medical emergency or a car accident can result in substantial financial burdens, even for young adults. Therefore, investing in the right insurance—a health plan, auto insurance, or renters insurance—earlier in life can provide you with peace of mind and financial security when you need it the most.