3D Printing Mastery – Unleash Your Creativity

Discover the art and science of 3D printing with tips, tutorials, and innovative designs.

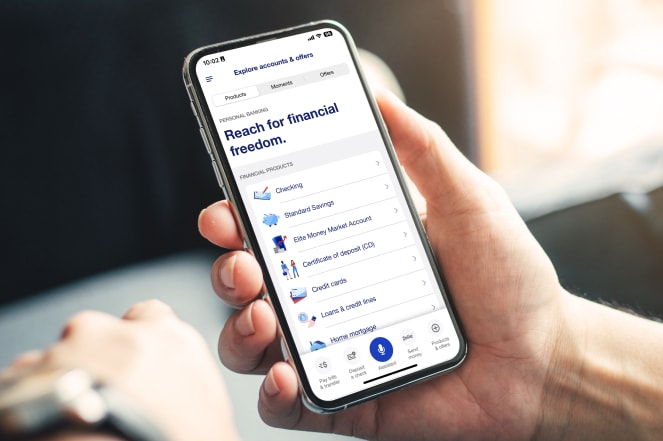

Banking: The Secret Life of Your Money

Discover the hidden truths of banking and unlock the secrets of your money. Dive in now and take control of your financial future!

Understanding Interest: How Your Money Grows in the Bank

Understanding interest is essential for anyone looking to maximize their savings. When you deposit money in a bank account, the bank pays you interest as a reward for allowing them to use your funds. This payment can be calculated using simple or compound interest. Simple interest is calculated only on the principal amount, while compound interest is calculated on both the principal and any interest earned previously, leading to potentially greater growth over time. Taking advantage of higher interest rates and compounding periods can significantly boost your savings.

Moreover, understanding how interest works can help you make informed decisions regarding your finances. For example, if you plan to save for a short-term goal, a high-yield savings account with a competitive interest rate might be ideal. In contrast, for long-term savings, you might consider certificates of deposit (CDs) or other investment vehicles that offer compounded interest. To visualize the impact of interest on your savings, consider the following factors:

- Amount of money deposited.

- Duration of time the money remains in the account.

- Type of interest applied (simple vs. compound).

- The frequency of compounding (daily, monthly, annually).

The Hidden Costs of Banking: What You Need to Know

When we think about banking, we often focus on the interest rates and fees stated in promotional materials. However, the hidden costs of banking can significantly impact our finances. For instance, many banks charge monthly maintenance fees that can accumulate over time. Additionally, ATM fees and foreign transaction fees may seem small, but they can add up quickly, leading to unexpected expenses that aren't clearly communicated at account opening. It’s essential for consumers to scrutinize their bank statements regularly to uncover these costs.

Moreover, the hidden costs of banking extend beyond just fees. Customers often overlook expenses such as overdraft fees and penalties related to low balances, which can further strain their financial health. In some cases, banks may also charge inactivity fees for accounts that aren’t used frequently. To avoid such pitfalls, it’s crucial to have a clear understanding of your bank's policies and to consider alternative banking options that offer more transparency. Keeping informed and proactive can save you from these hidden financial burdens.

Is Your Money Safe? Exploring Bank Security and Insurances

In today's financial landscape, many individuals ponder, Is your money safe? The security of your bank and its policies can significantly impact the safety of your hard-earned funds. Most banks employ advanced security measures, including encryption technologies, secure vaults, and employee training to protect against fraud and theft. Understanding how your bank safeguards your assets is essential for peace of mind. Additionally, consider the role of government-backed insurance programs, such as the Federal Deposit Insurance Corporation (FDIC) in the U.S., which insures deposits up to a certain limit, serving as a crucial safety net for consumers.

At the same time, it's vital to remain informed about personal banking practices that can further enhance your financial security. Here are some ways you can help protect your funds:

- Use strong, unique passwords for your online banking accounts.

- Enable two-factor authentication where available.

- Regularly monitor your bank statements for any suspicious activity.

- Be cautious with public Wi-Fi when accessing your bank accounts.

By taking these proactive steps, you can bolster your defense against potential threats and confidently ask yourself, Is your money safe?