3D Printing Mastery – Unleash Your Creativity

Discover the art and science of 3D printing with tips, tutorials, and innovative designs.

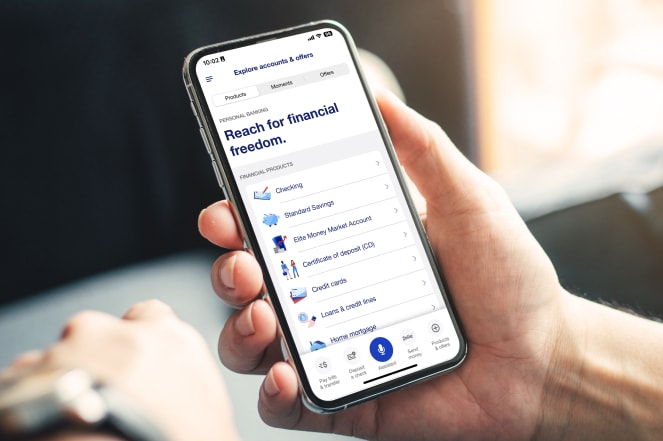

Banking Like a Boss: Secrets They Don’t Want You to Know

Unlock the hidden secrets of banking success! Discover tips and tricks they don't want you to know—start banking like a boss today!

5 Banking Hacks You Need to Know for Maximum Savings

When it comes to saving money, implementing effective banking hacks can make a significant difference in your financial health. Here are five banking hacks you need to incorporate into your routine for maximum savings:

- Utilize High-Interest Savings Accounts: Switch to a bank that offers higher interest rates on savings accounts. This simple move can boost your savings significantly over time.

- Set Up Automatic Transfers: Automate your savings by setting up a monthly transfer to your savings account. Even a small amount can accumulate quickly!

- Take Advantage of Account Features: Look for accounts that offer perks, like cash bonuses for maintaining a minimum balance or fee waivers.

- Use Budgeting Tools: Many banks provide budgeting tools that help you track your spending and identify areas where you can save more.

- Review Fees Regularly: Regularly check your bank statements for fees that can be avoided, and switch to fee-free accounts whenever possible.

The Hidden Fees Banks Won't Tell You About

When it comes to managing your finances, understanding the hidden fees associated with banking is crucial. Many customers are shocked to find that their banks are not entirely transparent about various charges. These fees can significantly impact your overall financial health. For example, banks often impose monthly maintenance fees that can range from $5 to $30, depending on the type of account. In addition to maintenance fees, overdraft fees are another prevalent hidden charge, often exceeding $30 per transaction, leaving customers reeling when trying to manage their balance.

Besides the more obvious charges, there are also transaction fees when using ATMs outside of your bank's network. These fees can add up quickly, especially if you frequently withdraw cash from different locations. Furthermore, some banks charge inactivity fees if you don't use your account for a certain period, which can feel like a penalty for simply being cautious with your spending. It’s essential to carefully read the fine print of your bank’s policies to avoid being caught off guard by these hidden costs.

Is Your Bank Working Against You? Discover the Truth

The financial landscape is increasingly complex, and many individuals often find themselves at the mercy of their banks. Is your bank working against you? This question is more than just a casual inquiry; it reflects a reality where hidden fees, unfavorable loan terms, and a lack of transparency can significantly impact your financial health. As consumers, we must be vigilant in our assessment of banking practices and determine whether the services provided genuinely align with our financial goals.

To uncover the truth, consider evaluating your current banking relationship through a series of reflective questions:

- Are you being charged monthly fees that you aren't fully aware of?

- Do you find your bank's interest rates too high compared to competitors?

- Have you ever felt overly pressured to purchase additional products or services?